On Friday, the USD rose 0.55% against the CHF and closed at 0.9264, following better than expected non-farm payrolls data in the US.

In economic news, real retail sales in Switzerland advanced 2.2% on an annual basis in December, compared to a revised decline of 0.6% registered in November. Meanwhile, the nation’s foreign currency reserves rose to CHF498.4 billion in January and compared to December’s reading of CHF495.1 billion.

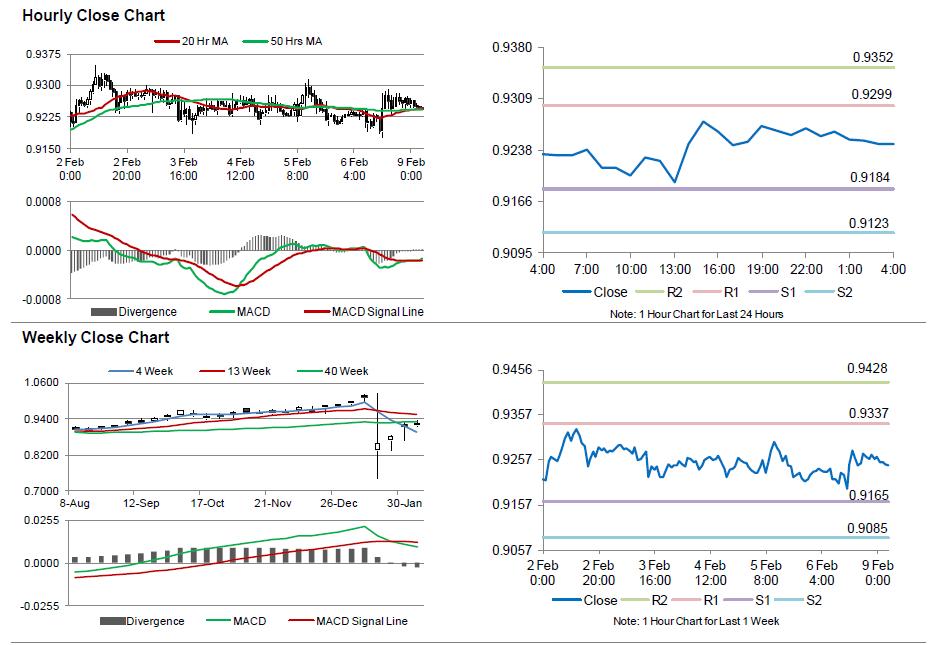

In the Asian session, at GMT0400, the pair is trading at 0.9246, with the USD trading 0.2% lower from Friday’s close.

Early this morning, the SNB President, Thomas Jordan mentioned that the SNB stands ready to slash its deposit rate further, in order to minimise the overvaluation of the Franc.

The pair is expected to find support at 0.9184, and a fall through could take it to the next support level of 0.9123. The pair is expected to find its first resistance at 0.9299, and a rise through could take it to the next resistance level of 0.9352.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.