For the 24 hours to 23:00 GMT, the USD declined 1.38% against the JPY and closed at 100.32.

In economic news, data suggested that Japan’s final machine tool orders dropped by 8.4% YoY in August, confirming the preliminary print.

Separately, the Organisation for Economic Co-operation and Development (OECD), revised down Japan’s 2016 economic growth forecast to 0.6%, from 0.7% estimated earlier, citing appreciation in the Japanese Yen and weakness in the nation’s exports.

In the Asian session, at GMT0300, the pair is trading at 100.40, with the USD trading 0.08% higher against the JPY from yesterday’s close.

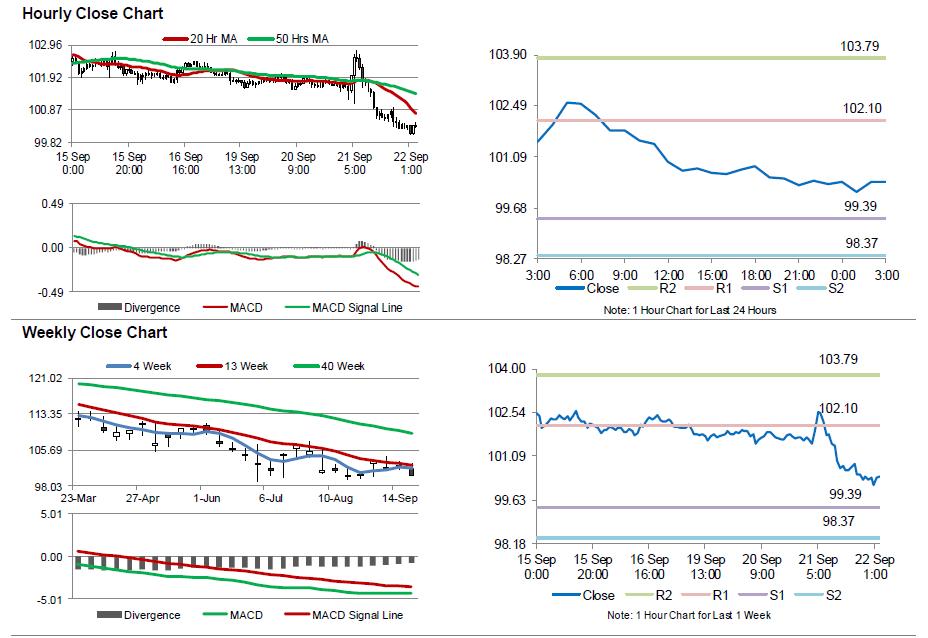

The pair is expected to find support at 99.39, and a fall through could take it to the next support level of 98.37. The pair is expected to find its first resistance at 102.10, and a rise through could take it to the next resistance level of 103.79.

On account of a holiday in Japan today, investors would look forward to global macroeconomic factors for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.