For the 24 hours to 23:00 GMT, the USD weakened 1.10% against the JPY and closed at 109.52.

In the Asian session, at GMT0300, the pair is trading at 108.93, with the USD trading 0.54% lower from yesterday’s close.

Overnight data showed that, Japan’s monetary base advanced 25.5% YoY in May, following a 26.8% rise in the previous month.

Early this morning, the Bank of Japan (BoJ) board member, Takehiro Sato, expressed pessimism regarding the central bank’s negative interest rate policy and urged the BoJ to adopt a policy framework suitable for long-term battle against deflation.

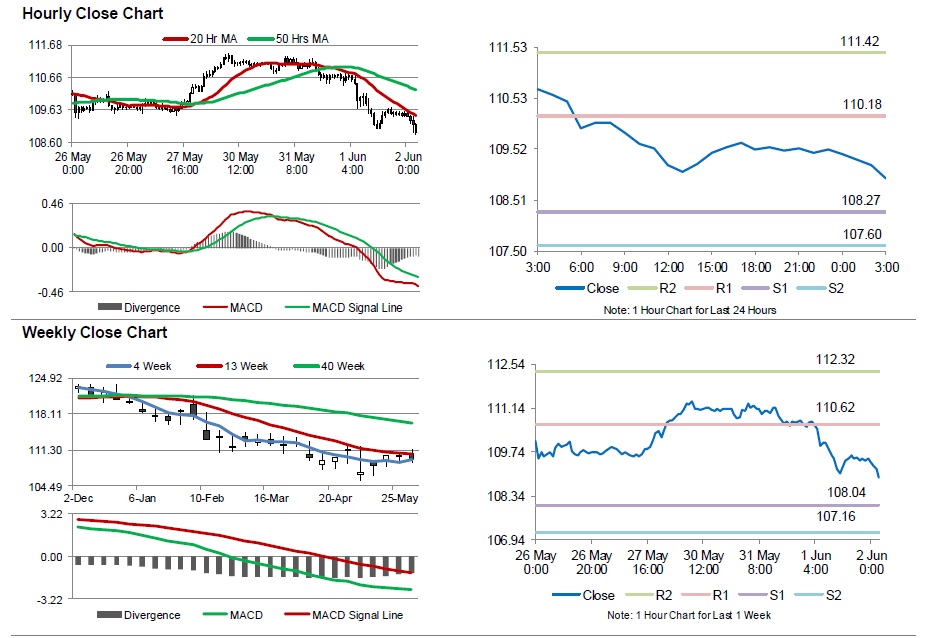

The pair is expected to find support at 108.27, and a fall through could take it to the next support level of 107.60. The pair is expected to find its first resistance at 110.18, and a rise through could take it to the next resistance level of 111.42.

Going ahead, investors will look forward to the release of Japan’s consumer confidence index data for May, due in some time.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.