For the 24 hours to 23:00 GMT, the USD weakened 0.25% against the JPY and closed at 106.91. The Japanese currency gained ground after Japan’s leading economic index climbed to 104.4 in August, after registering a preliminary level of 104.0 in the prior month.

In other economic data, coincident index in Japan fell to a reading of 108.3 in August, following a preliminary level of 108.5 in July. Meanwhile, Japan’s nationwide department store sales slid 0.7% on an annual basis in September, compared to 0.3% drop registered in the previous month.

In the Asian session, at GMT0300, the pair is trading at 106.76, with the USD trading 0.15% lower from yesterday’s close.

Early this morning, the BoJ in its quarterly report reported that most of the Japanese regional economies would continue to recover moderately as a trend, as the effect from a sales tax increase in April would gradually ease.

Data just released indicated that, Japan’s all industry activity index dropped 0.1% on a monthly basis in August, compared to a revised fall of 0.4% registered in July.

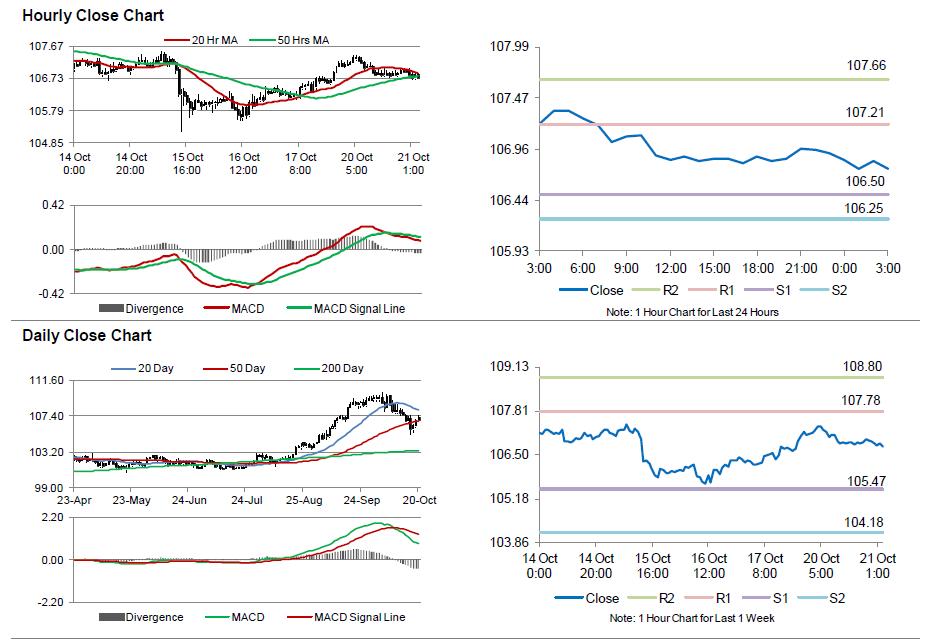

The pair is expected to find support at 106.50, and a fall through could take it to the next support level of 106.25. The pair is expected to find its first resistance at 107.21, and a rise through could take it to the next resistance level of 107.66.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.