For the 24 hours to 23:00 GMT, the USD weakened 0.15% against the JPY and closed at 124.41.

On the macro front, Japan’s consumer confidence index unexpectedly fell to 41.4 in May, from prior month’s level of 41.5. Markets were expecting the index to advance to a level of 41.9. Meanwhile, machine tool orders in Japan climbed 15.00% on a YoY basis, in May. In the prior month, machine tool orders had advanced 10.50%.

In the Asian session, at GMT0300, the pair is trading at 124.52, with the USD trading 0.09% higher from yesterday’s close.

Earlier today, the BoJ Governor, Haruhiko Kuroda, opined that he expects the central bank to achieve its 2% inflation target around first half of FY 2016. He further reiterated that the BoJ will continue with its stimulus measures and if needed will adjust monetary policy.

Overnight data revealed that machine orders in Japan surprisingly rose 3.8% MoM in April, compared to an increase of 2.9% in March.

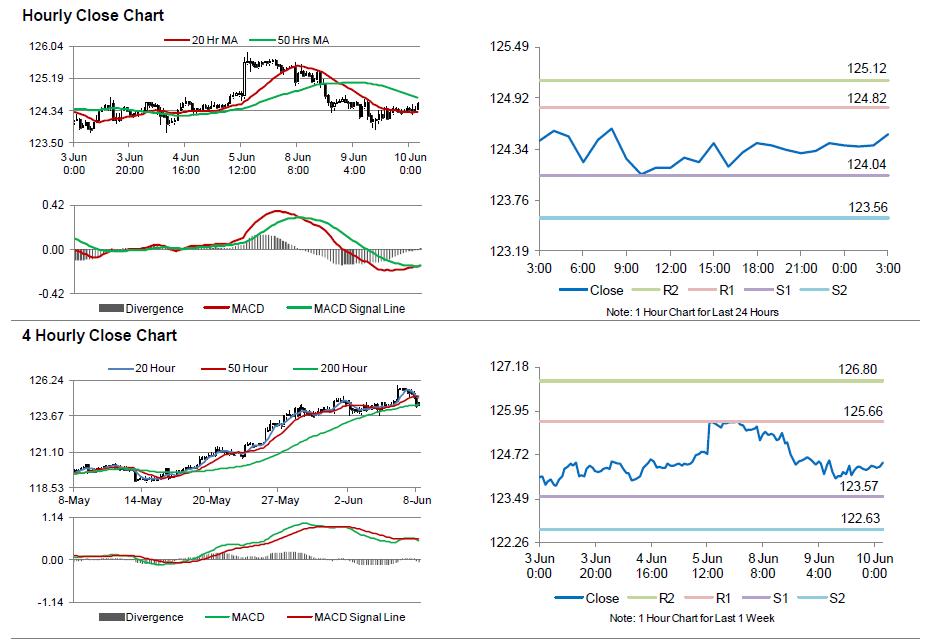

The pair is expected to find support at 124.04, and a fall through could take it to the next support level of 123.56. The pair is expected to find its first resistance at 124.82, and a rise through could take it to the next resistance level of 125.12.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.