For the 24 hours to 23:00 GMT, the USD strengthened 0.25% against the JPY and closed at 102.86.

In the Asian session, at GMT0300, the pair is trading at 102.75, with the USD trading 0.11% lower against the JPY from yesterday’s close.

Overnight data showed that, Japan’s preliminary industrial production declined more-than-expected by 2.3% MoM in May, reversing two months of solid gains and recording its lowest level since June 2013, as a drop in exports hit most of the country’s manufacturing sectors. Market expectation was for industrial production to fall 0.2%, following a 0.5% gain in the previous month.

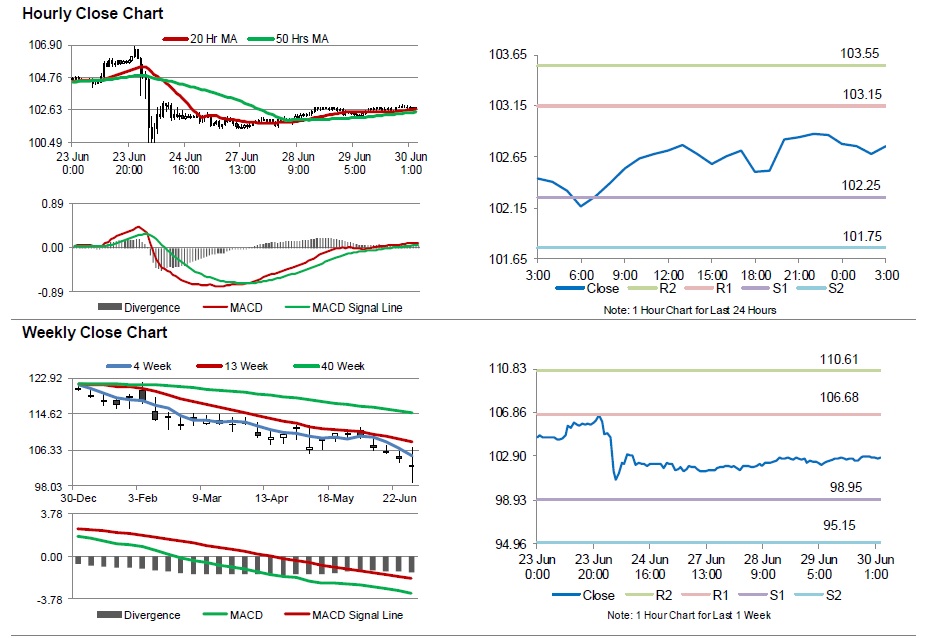

The pair is expected to find support at 102.25, and a fall through could take it to the next support level of 101.75. The pair is expected to find its first resistance at 103.15, and a rise through could take it to the next resistance level of 103.55.

Moving ahead, investors will look forward to Japan’s national consumer price index, unemployment rate and the Tankan Q2 survey data, all due overnight.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.