For the 24 hours to 23:00 GMT, the USD weakened 0.41% against the JPY and closed at 101.68.

In economic news, Japan’s preliminary leading index surprisingly advanced to a level of 100.0 in July, from a reading of 99.2 in the previous month. Also, the nation’s flash coincident index rose above expectations to a level of 112.8 in July, compared to the prior month’s reading of 111.1.

In the Asian session, at GMT0300, the pair is trading at 101.65, with the USD trading marginally lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s final GDP unexpectedly rose 0.2% QoQ in 2Q 2016, driven by upward revisions to capital expenditure and inventories. The preliminary figures had recorded a steady reading, compared to a rise of 0.5% in the prior quarter. On the other hand, the nation’s BOP Basis trade surplus narrowed to ¥613.9 billion in July, from a reading of ¥763.6 billion in the previous month.

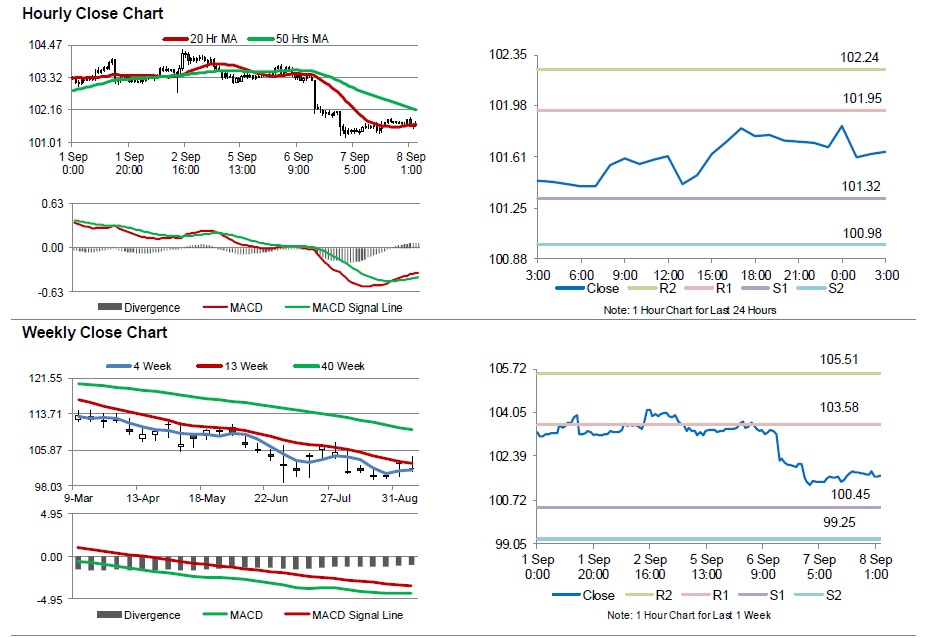

The pair is expected to find support at 101.32, and a fall through could take it to the next support level of 100.98. The pair is expected to find its first resistance at 101.95, and a rise through could take it to the next resistance level of 102.24.

Moving ahead, market participants await the release of Japan’s Eco Watchers survey for August, due in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.