For the 24 hours to 23:00 GMT, the USD declined 2.26% against the JPY and closed at 107.66.

On the data front, Japan’s construction orders unexpectedly rose 0.7% on a yearly basis in February, defying market expectations for a decline of 0.7% and compared to a plunge of 17.0% in the prior month. Additionally, the nation’s housing starts dropped 12.3% on an annual basis in February, registering its eighth consecutive decline and less than market anticipations for a drop of 14.7%. In the prior month, housing starts had recorded a drop of 10.1%.

In the Asian session, at GMT0300, the pair is trading at 107.66, with the USD trading flat against the JPY from yesterday’s close.

Overnight data showed that Japan’s Jibun Bank manufacturing PMI fell to a level of 44.8 in March, in line with market forecast and compared to a revised rise of 47.8 in the earlier month.

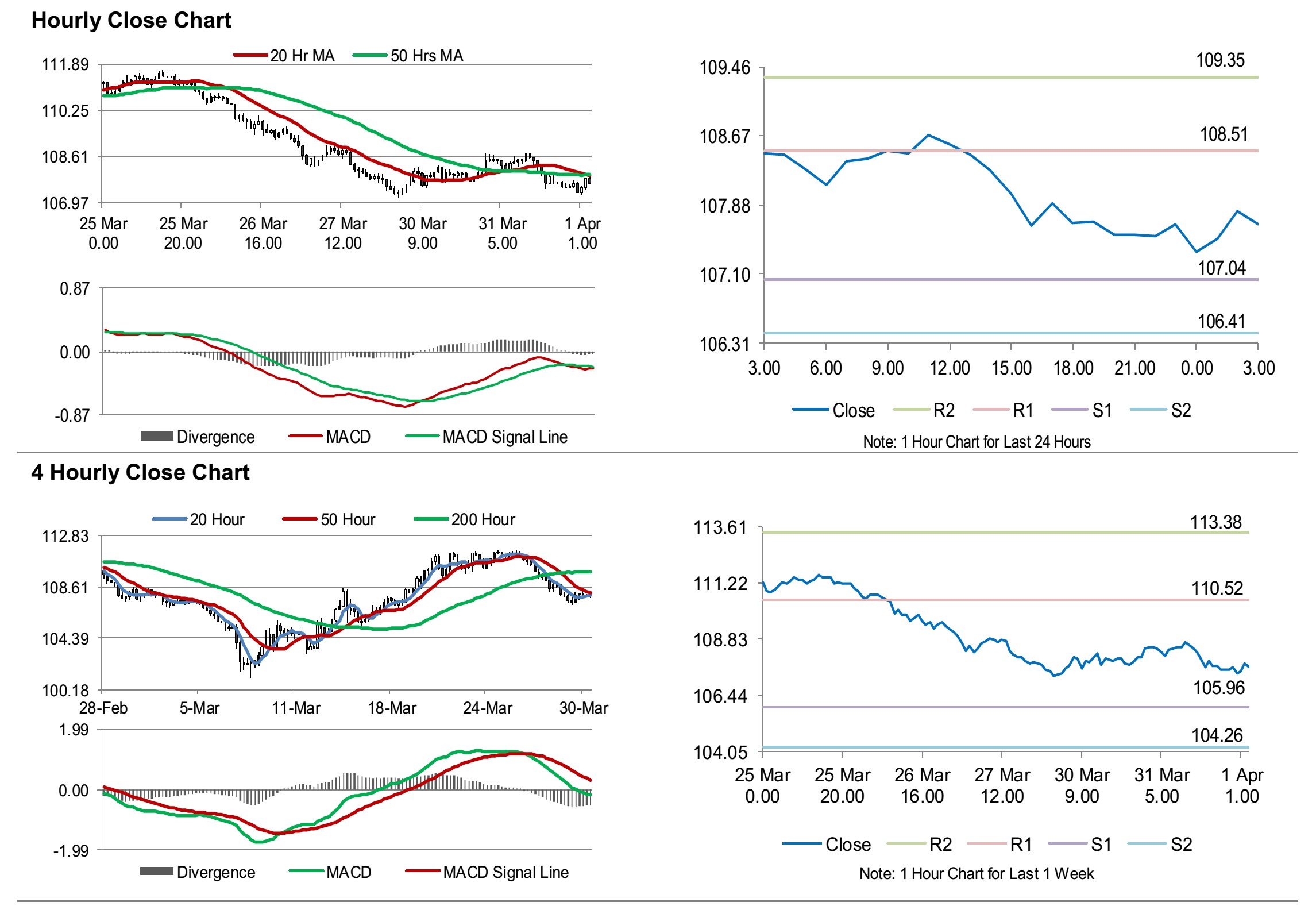

The pair is expected to find support at 107.04, and a fall through could take it to the next support level of 106.41. The pair is expected to find its first resistance at 108.51, and a rise through could take it to the next resistance level of 109.35.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.