For the 24 hours to 23:00 GMT, the USD rose 0.48% against the JPY and closed at 100.8.

In the Asian session, at GMT0300, the pair is trading at 101.09, with the USD trading 0.29% higher against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s preliminary Nikkei manufacturing PMI climbed to a level of 50.3 in September, crawling out of the contraction territory for the first time in seven months, thus reviving hopes that growth could pick up in the world’s third largest economy. The index recorded a reading of 49.5 in the previous month.

Earlier today, data indicated that the nation’s all industry activity index rose more-than-expected by 0.3% MoM in July, surpassing market expectations for an advance of 0.2% and after recording a gain of 1.0% in the preceding month.

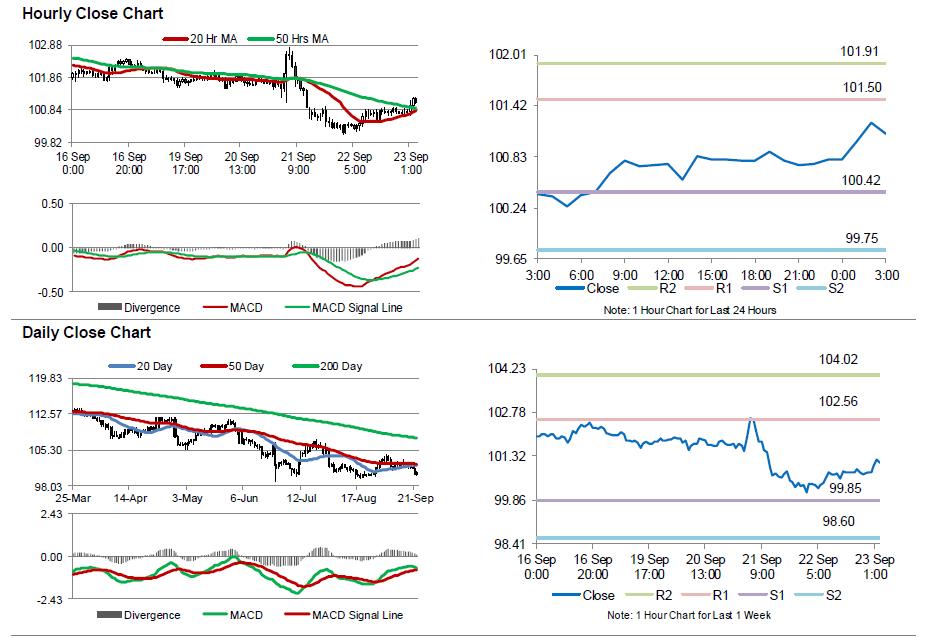

The pair is expected to find support at 100.42, and a fall through could take it to the next support level of 99.75. The pair is expected to find its first resistance at 101.50, and a rise through could take it to the next resistance level of 101.91.

Looking ahead, market participants would closely monitor the BoJ Governor, Haruhiko Kuroda’s speech, consumer price inflation, unemployment rate, minutes of the BoJ’s recent monetary policy meeting, all scheduled next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.