For the 24 hours to 23:00 GMT, the USD weakened 0.06% against the JPY and closed at 123.91.

Yesterday, the IMF warned Japan that it needs to step up reforms in order to curb the risks pertaining to slowing economic growth in the nation. Further, the agency also projected that the Japanese economy would expand 0.8% in 2015 and 1.2% in 2016.

In the Asian session, at GMT0300, the pair is trading at 123.91, with the USD trading flat from yesterday’s close.

Early morning data showed that the preliminary estimate of Japan’s manufacturing PMI climbed to 5-month high level of 51.4 in July, following a reading of 50.1 in the previous month, highlighting that economic growth in Japan is picking up.

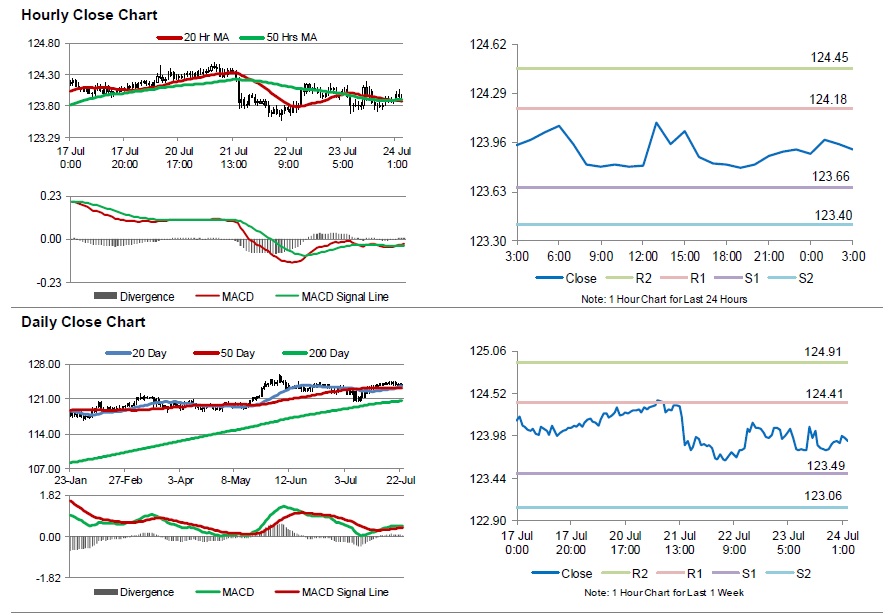

The pair is expected to find support at 123.66, and a fall through could take it to the next support level of 123.4. The pair is expected to find its first resistance at 124.18, and a rise through could take it to the next resistance level of 124.45.

Going forward, investors would closely monitor Japan’s retail trade and consumer prices data, scheduled to release in the next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.