For the 24 hours to 23:00 GMT, the USD weakened 0.18% against the JPY and closed at 102.31. The Japanese yen rose as escalating tensions between Russia and Ukraine bolstered its safe-haven appeal.

In the Asian session, at GMT0300, the pair is trading at 102.41, with the USD trading 0.10% higher from yesterday’s close.

Earlier today, data showed that Japan’s annual consumer inflation rate rose to 1.6% in March, from previous month’s level of 1.5%. Following the release of Japan’s inflation rate data, Japanese Finance Minister, Taro Aso commented that the nation’s consumer price data indicates that things are proceeding well in Japan’s efforts to shake off deflation. However, at the same time, he opined that the month-on-month gains in Japan’s consumer prices would be of more importance than the annual gains after the recent sales tax hike in April.

Also earlier today, data showed that Japan’s all industry activity index declined 1.1% (MoM) in February, more than market expectations and following a 1.7% rise in the preceding month.

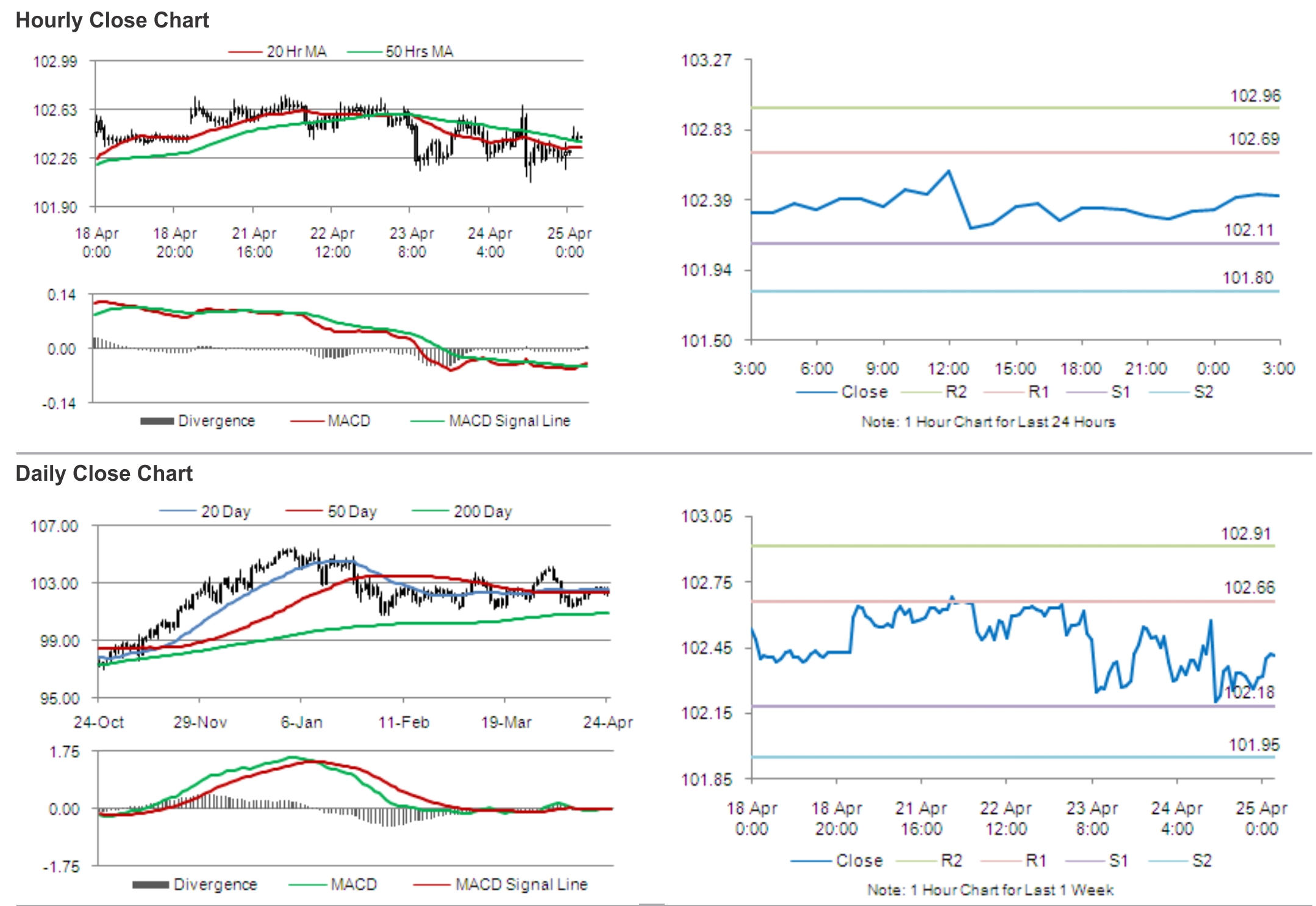

The pair is expected to find support at 102.11, and a fall through could take it to the next support level of 101.80. The pair is expected to find its first resistance at 102.69, and a rise through could take it to the next resistance level of 102.96.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.