For the 24 hours to 23:00 GMT, the USD rose 0.38% against the JPY and closed at 101.18.

Yesterday, the BoJ Governor, Haruhiko Kuroda, stated that the BoJ will pursue the most appropriate yield curve to achieve its 2.0% inflation target and also added that the central bank is ready to ease policy further by cutting its short-term and long-term interest rate targets or expanding risky asset purchases. Further, he also noted that the bank can also choose to expand the monetary base faster, if found necessary.

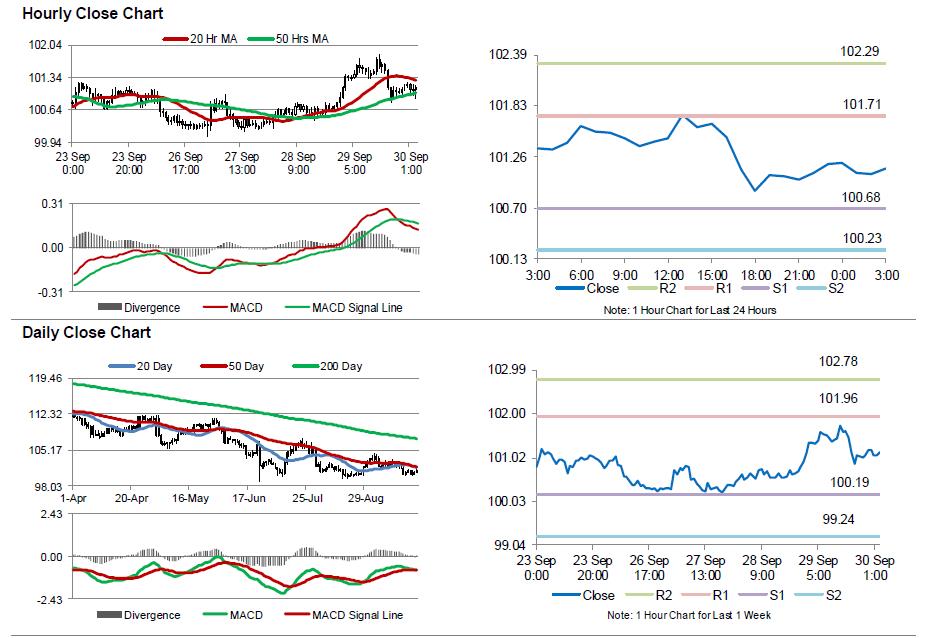

In the Asian session, at GMT0300, the pair is trading at 101.13, with the USD trading a tad lower against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s unemployment rate unexpectedly rose to 3.1% in August, against market expectations for it to remain steady at 3.0%, recorded in the preceding month. Additionally, the nation’s national consumer price index (CPI) slid 0.5% on an annual basis in August, at par with market expectations, declining for a sixth consecutive month, thus keeping the Bank of Japan under pressure to do more to spur inflation. The CPI had recorded a drop of 0.4% in the prior month. On the other hand, the nation’s flash industrial production rebounded more-than-anticipated by 1.5% on a monthly basis in August, rising at the fastest pace in more than two-years. Markets expected it to rise by 0.5%, after registering a drop of 0.4% in the prior month.

The pair is expected to find support at 100.68, and a fall through could take it to the next support level of 100.23. The pair is expected to find its first resistance at 101.71, and a rise through could take it to the next resistance level of 102.29.

Going ahead, Japan’s Tankan large manufacturers index for 2Q 2016, due to release in the weekend, would be on investor’s radar.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.