For the 24 hours to 23:00 GMT, the USD strengthened 0.15% against the JPY and closed at 121.72.

In the Asian session, at GMT0400, the pair is trading at 121.66, with the USD trading marginally lower from yesterday’s close.

Early morning data showed that Japan’s preliminary coincident index fell to a level of 111.9 in September, from a reading of 112.2 in the previous month. Investors had expected it to decline to a level of 112.1. Also, the nation’s flash leading index dropped less-than-expected to a level of 101.4, from 103.5 in the previous month. Market participants had expected a fall of 101.8.

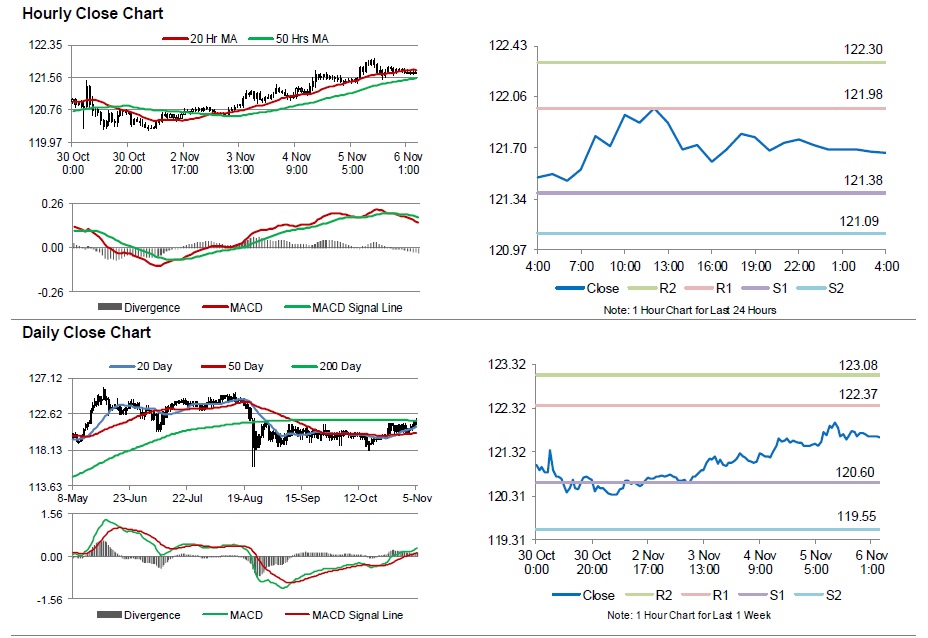

The pair is expected to find support at 121.38, and a fall through could take it to the next support level of 121.09. The pair is expected to find its first resistance at 121.98, and a rise through could take it to the next resistance level of 122.30.

Moving ahead, investors will look out for Japan’s Eco Watchers outlook survey and industrial production data, scheduled to be release next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.