For the 24 hours to 23:00 GMT, the USD weakened 0.64% against the JPY and closed at 108.82.

In economic news, Japan’s consumer confidence index surprisingly advanced to a level of 40.9 in May, from a reading of 40.8 in the previous month, while markets were anticipating the index to fall to a level of 40.1.

In the Asian session, at GMT0300, the pair is trading at 108.86, with the USD trading marginally higher from yesterday’s close.

Early this morning, data showed that Japan’s Nikkei services PMI bounced back into expansionary territory by recording a reading of 50.4 in May, led by a modest increase in new orders, from a level of 49.3 in the previous month.

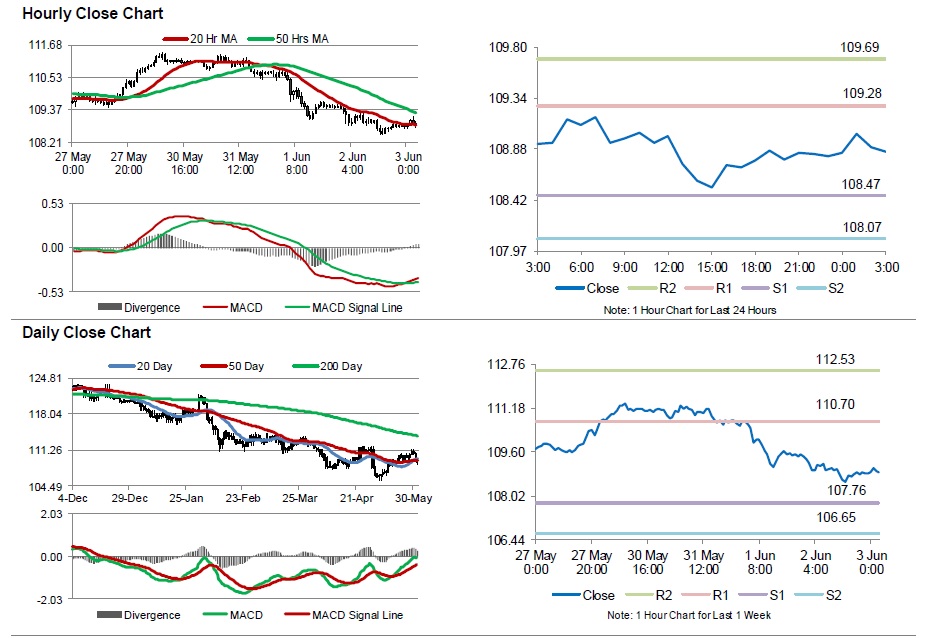

The pair is expected to find support at 108.47, and a fall through could take it to the next support level of 108.07. The pair is expected to find its first resistance at 109.28, and a rise through could take it to the next resistance level of 109.69.

Moving ahead, investors will look forward to Japan’s Q1 GDP, trade balance, Eco Watchers survey and machine tool orders data, all scheduled to release next week.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.