For the 24 hours to 23:00 GMT, the USD ended the day flat against the JPY and closed at 102.31. However, the greenback continued to trade on a high footing mostly during the day after the Fed’s January meeting revealed some policymakers were pushing to raise interest rates and the central bank would continue with its tapering plans.

In the Asian session, at GMT0400, the pair is trading at 101.95, with the USD trading 0.36% lower from yesterday’s close. The yen is trading higher against the major currencies as weak Chinese manufacturing data provided a boost to its safe haven appeal.

Meanwhile, the total merchandised trade deficit in Japan widened more-than-expected to a monthly record of ¥2,790.0 billion in January, from a deficit of ¥1,304.2 billion registered in the preceding month. The report also pointed towards a hefty rise in the nation’s import level in January and a less-than-expected gain in the nation’s export during January.

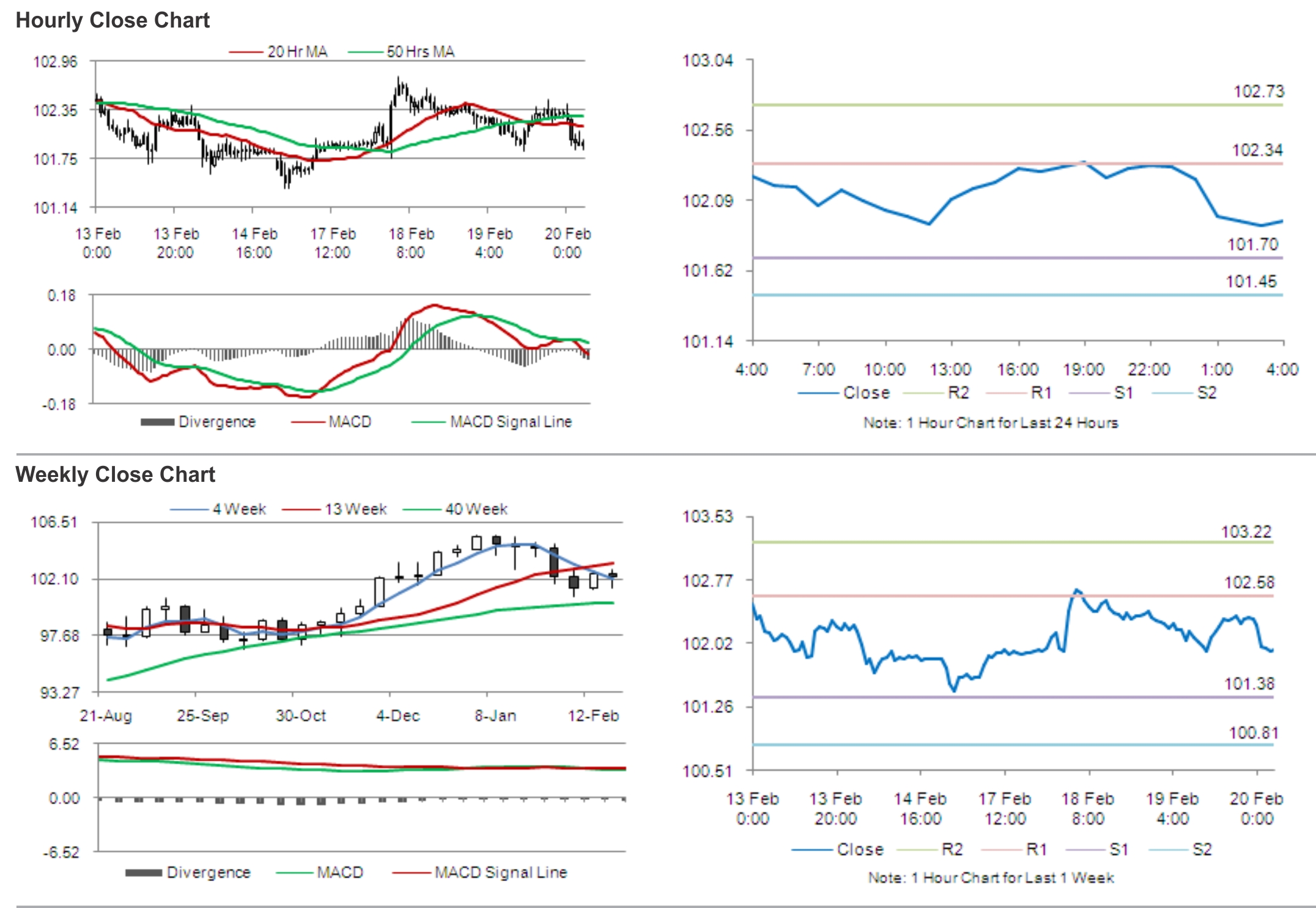

The pair is expected to find support at 101.70, and a fall through could take it to the next support level of 101.45. The pair is expected to find its first resistance at 102.34, and a rise through could take it to the next resistance level of 102.73.

Amid lack of economic releases from Japan during the later course of the day, traders would eye the minutes from the Bank of Japan’s latest policy meeting, due for release early Friday.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.