For the 24 hours to 23:00 GMT, the USD strengthened 0.21% against the JPY and closed at 116.90.

In the Asian session, at GMT0400, the pair is trading at 117.25, with the USD trading 0.3% higher from yesterday’s close.

Earlier today, the BoJ in its monetary policy statement maintained its recently-revised target for boosting the nation’s monetary base by an annual pace of about ¥80 trillion and reiterated that the country’s economy was recovering moderately, despite the GDP data showing that the country had unexpectedly fell into recession, following the April sale tax hike. It further indicated that the nation’s current CPI is around 1% and is expected to stay at this level for some time.

Data just released indicated that Japan’s all industry activity index rebounded 1.0% on a monthly basis in September, at par with market expectations. It had dropped 0.1% in the preceding month. Meanwhile, the nation’s leading index remained unchanged at previous month’s reading of 105.6 in September.

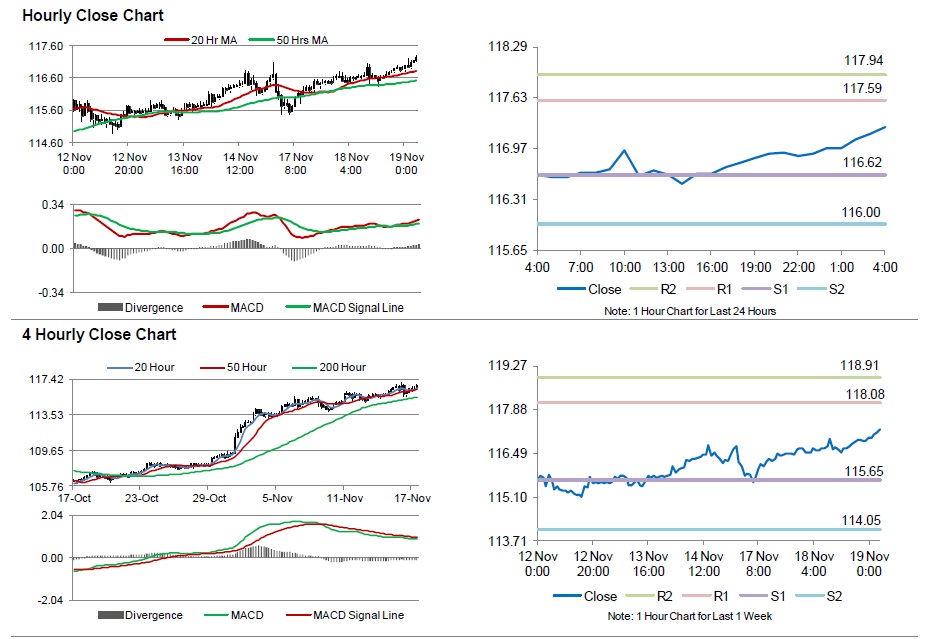

The pair is expected to find support at 116.62, and a fall through could take it to the next support level of 116. The pair is expected to find its first resistance at 117.59, and a rise through could take it to the next resistance level of 117.94.

Meanwhile, market participants look forward to Japan’s adjusted merchandise trade balance data, scheduled overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.