For the 24 hours to 23:00 GMT, the USD weakened 0.33% against the JPY and closed at 101.27.

The JPY gained ground after the consumer confidence in Japan improved to its highest level in six months in June.

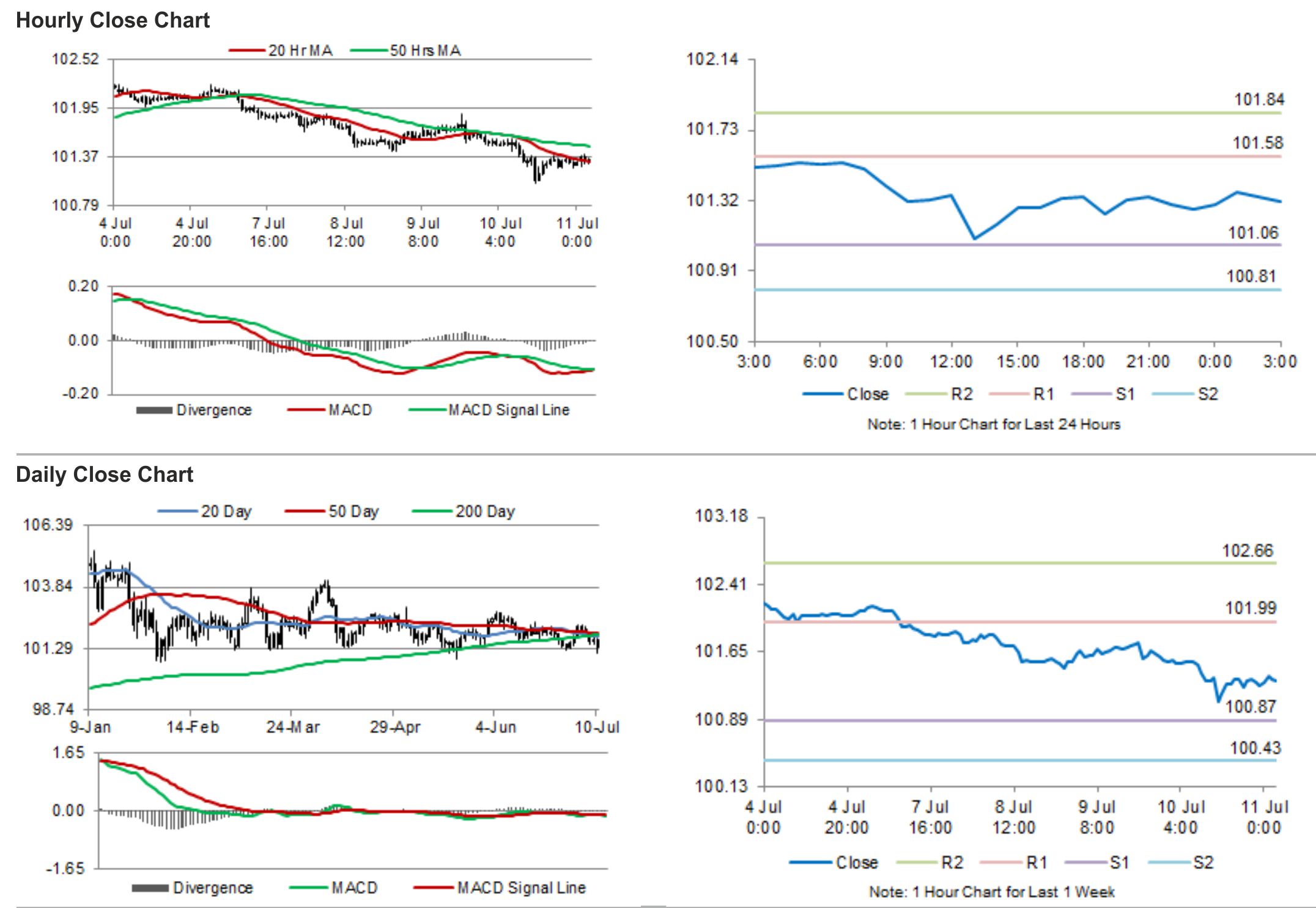

In the Asian session, at GMT0300, the pair is trading at 101.32, with the USD trading tad higher from yesterday’s close.

Earlier this morning, Japanese Economy Minister, Akira Amari, cautioned that it was too early to discuss any kind of exit strategies from its massive stimulus programme as the economy had just started showing signs of improvement, after being mired for 15 years in deflation. However, he assured that the central would not think twice before undertaking more measures if at any point of time it feels that the economy is drifting from its targets.

The pair is expected to find support at 101.06, and a fall through could take it to the next support level of 100.81. The pair is expected to find its first resistance at 101.58, and a rise through could take it to the next resistance level of 101.84.

With no economic releases from Japan scheduled today, trading trends in the pair would be determined by global factors

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.