For the 24 hours to 23:00 GMT, the USD strengthened 0.06% against the JPY and closed at 102.31, following strong US ISM manufacturing PMI and consumer spending data.

Yesterday, an industry report revealed that the vehicle deliveries last month declined to to the lowest since December 2012 after Japan raised its consumption tax for the first time 17 years.

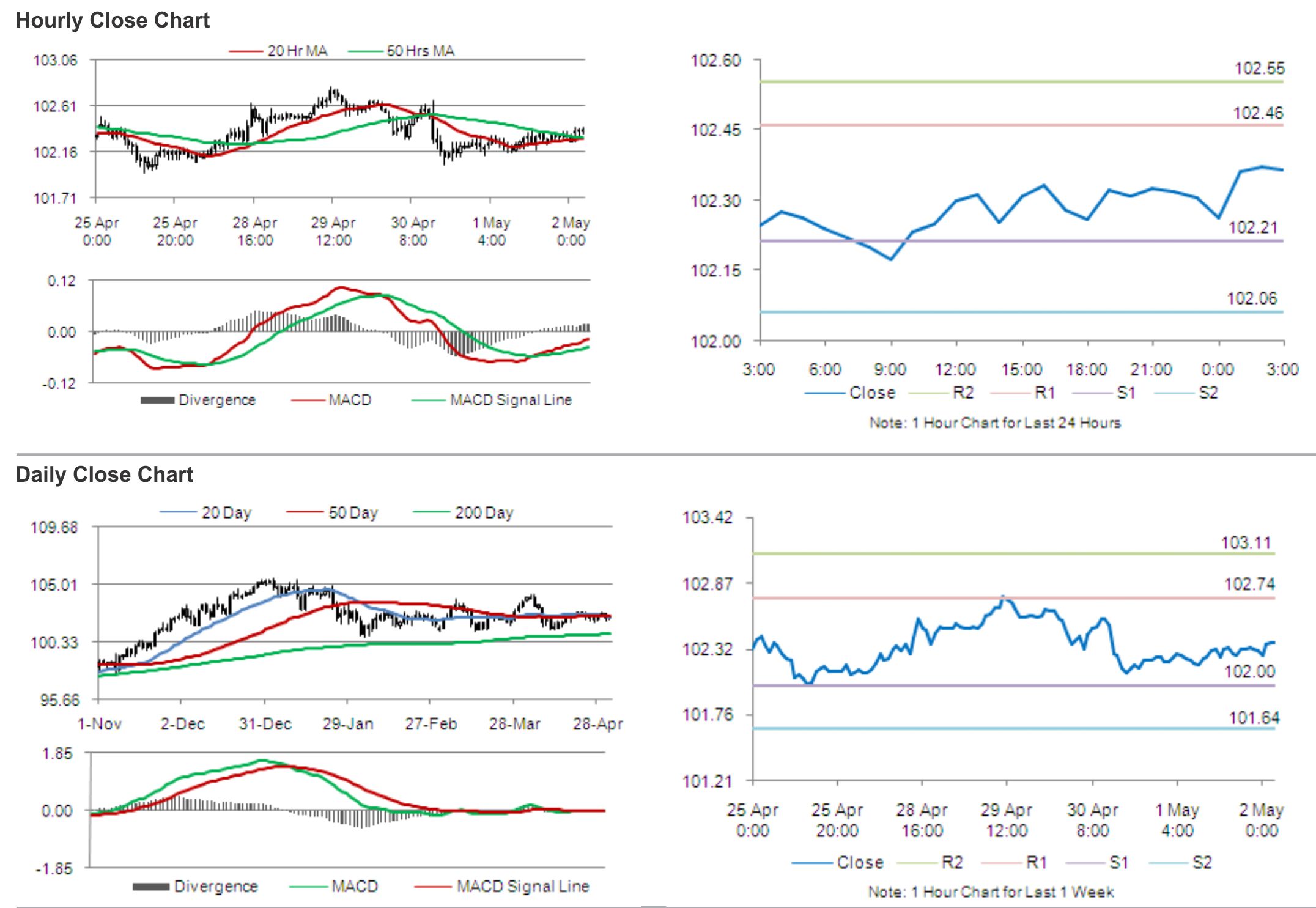

In the Asian session, at GMT0300, the pair is trading at 102.37, with the USD trading 0.06% higher from yesterday’s close.

This morning, the Japanese Prime Minister, Shinzo Abe urged that in order to beat deflation, the country has to witness a rise in wages and employment. Additionally, he pointed to the improving sentiment among small and mid-size companies in the nation and vowed that he would see to it that economic partnership between Japan and Europe flourishes in the near future.

Earlier today, a top government spokesman, Yoshihide Suga opined that “job conditions are improving steadily” in the Japan and further added that the decline in spending post the tax hike is in par with the government’s expectations so far. Meanwhile, an official report showed that unemployment rate in the nation stood pat at 3.6%, the lowest since July 2007 while job creation accelerated to 520,000 in March from a year earlier. Separately, overall household spending in the world’s third largest economy, Japan, soared more-than-expected 7.2% (YoY) in March, its fastest annual pace in four decades while Japan’s monetary base climbed 48.5% on year in April.

The pair is expected to find support at 102.21, and a fall through could take it to the next support level of 102.06. The pair is expected to find its first resistance at 102.46, and a rise through could take it to the next resistance level of 102.55.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.