For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.6890, after Markit PMI for the UK manufacturing sector rose more than market expectations to a reading of 57.3 in April, the highest since November 2013. Positive sentiment for the UK Pound was also fuelled after the Nationwide house prices recorded its biggest annual gain since June 2007 in March and after UK consumer credit rose to an 18-month high of £1.1 billion in March. However, mortgage approvals in the Britain economy fell for the second consecutive month in March while net lending to individuals rose more-than-expected by £2.9 billion to reach £1.44 trillion in March.

Meanwhile, the BoE Deputy Governor, Jon Cunliffe highlighted his concerns regarding the continuous rise in the UK housing prices since the spring of last year, as according to him they constitute the most dreadful risk to the nation’s financial stability.

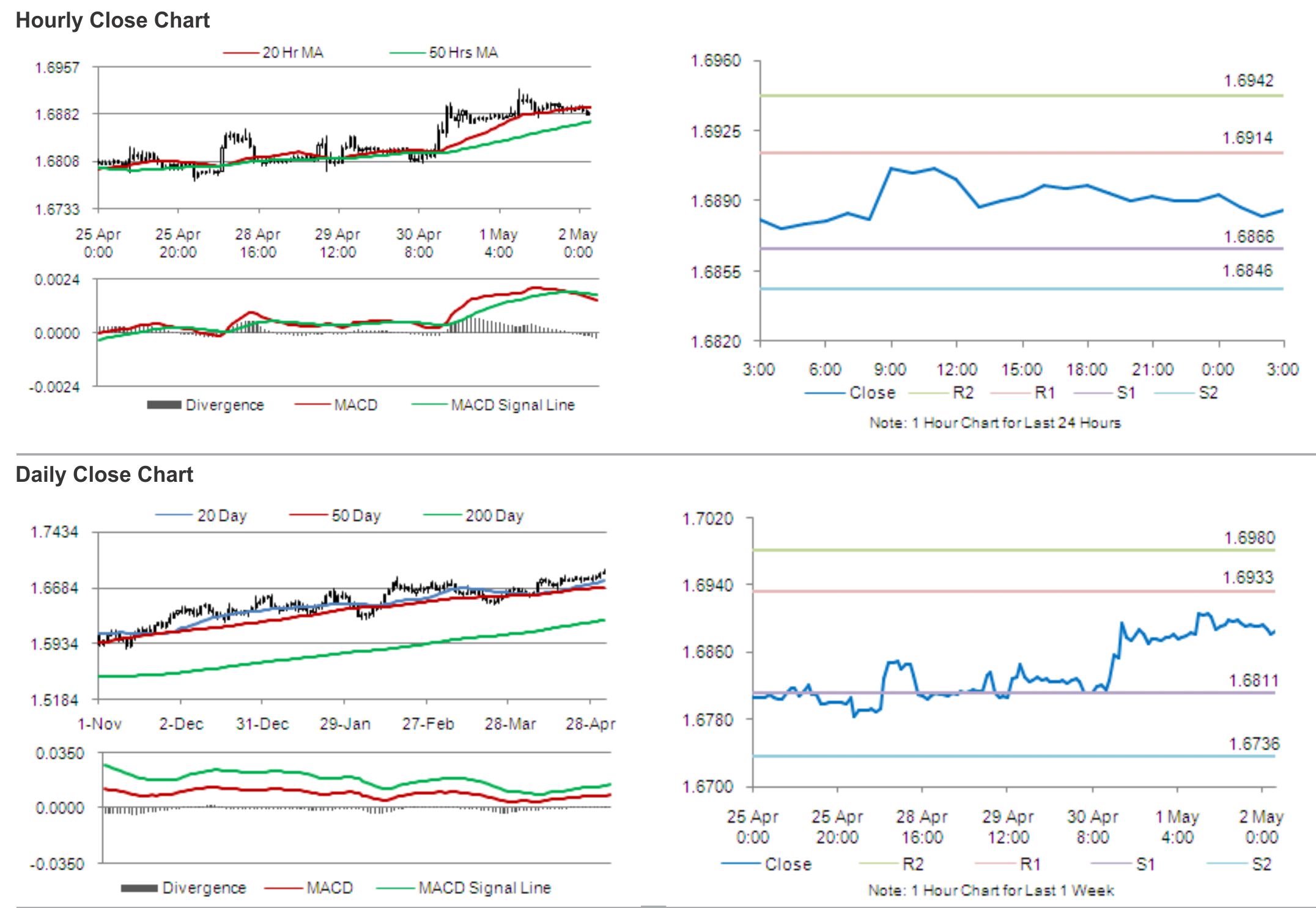

In the Asian session, at GMT0300, the pair is trading at 1.6885, with the GBP trading tad lower from yesterday’s close.

The pair is expected to find support at 1.6866, and a fall through could take it to the next support level of 1.6846. The pair is expected to find its first resistance at 1.6914, and a rise through could take it to the next resistance level of 1.6942.

Market participants are expected to keep a tab on UK’s construction PMI data, slated for release later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.