For the 24 hours to 23:00 GMT, USD weakened 0.91% against the JPY and closed at 77.55, amid concerns over a US economic slowdown following the downgrade of the US government’s credit rating on late Friday.

In Japan, yesterday, the current conditions index climbed to 52.6 in July, from 49.6 posted in June. The outlook index retreated to a reading of 48.5 in July, compared to a reading of 49.0 posted in June.

Meanwhile, in the morning economic news, the Bank of Japan (BoJ) indicated that, on an annual basis, the M2 money supply climbed 2.9% in July, and in-line with market estimates. Also, on an annual basis, the M3 money stock rose 2.3%, compared to an upwardly revised 2.3% gain recorded in the previous month. Moreover, the Tokyo Shoko Research indicated that, on an annual basis, the corporate bankruptcies rose 1.4% to 1,081 cases in July.

The minutes of the Japanese central bank indicated that the Bank of Japan (BoJ) policy board members continued to see the potential need for further credit easing to ensure the country’s economic recovery.

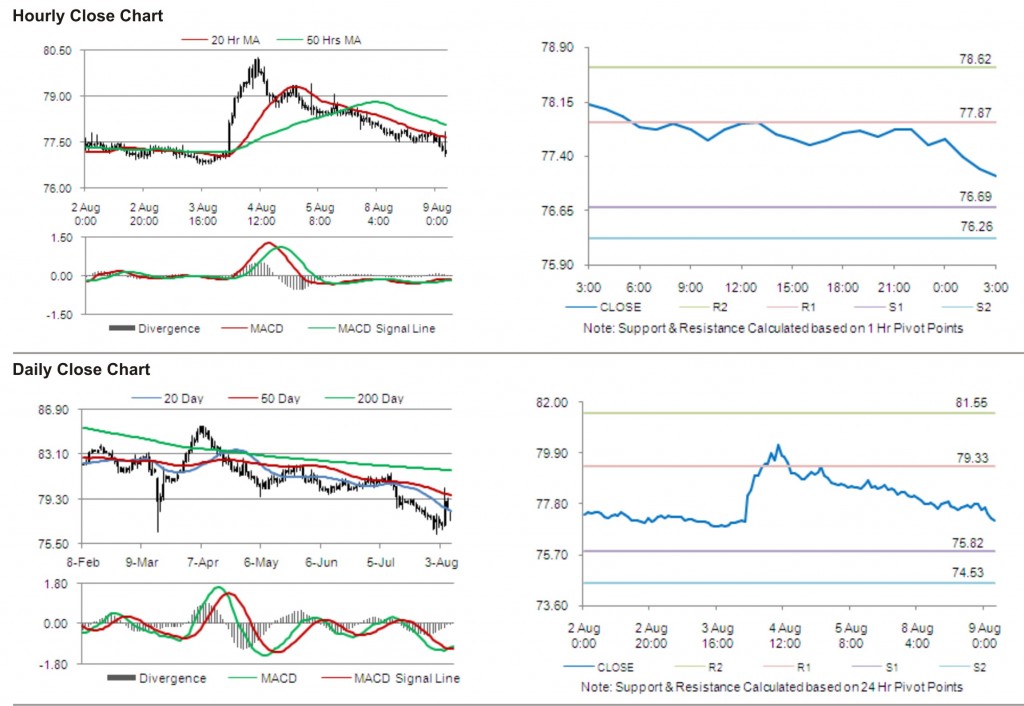

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.55%, at 77.12.

The first short term resistance is at 77.87, followed by 78.62. The pair is expected to find support at 76.69 and the subsequent support level at 76.26.

The pair is expected to trade on the cues from the release of consumer confidence data and tertiary industry index in Japan.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.