For the 24 hours to 23:00 GMT, USD weakened 1.21% against the JPY, on Friday, and closed at 78.37.

In Japan, on Friday, the bank lending, on an annual basis, dropped 0.6% to ¥392.745 trillion in July. Meanwhile, the leading index climbed to 103.2 in June, from a score of 99.4 posted in May. Also, the coincident index rose to a reading of 108.6 in June, following a reading of 106.1 recorded in the previous month.

On late Friday, Standard & Poor’s downgraded U.S. sovereign credit rating by one notch to ‘AA+’ from ‘AAA’ with a negative outlook.

Additionally, this morning, the current account surplus retreated to ¥526.9 billion in June, from a current account surplus of ¥590.7 billion in May, while the trade surplus stood at ¥131.5 billion in June, compared to a trade deficit of ¥772.7 billion recorded in the previous month.

In the Asian session at 3:00GMT, the pair is trading lower from Friday’s close at 23:00 GMT, by 0.33%, at 78.11.

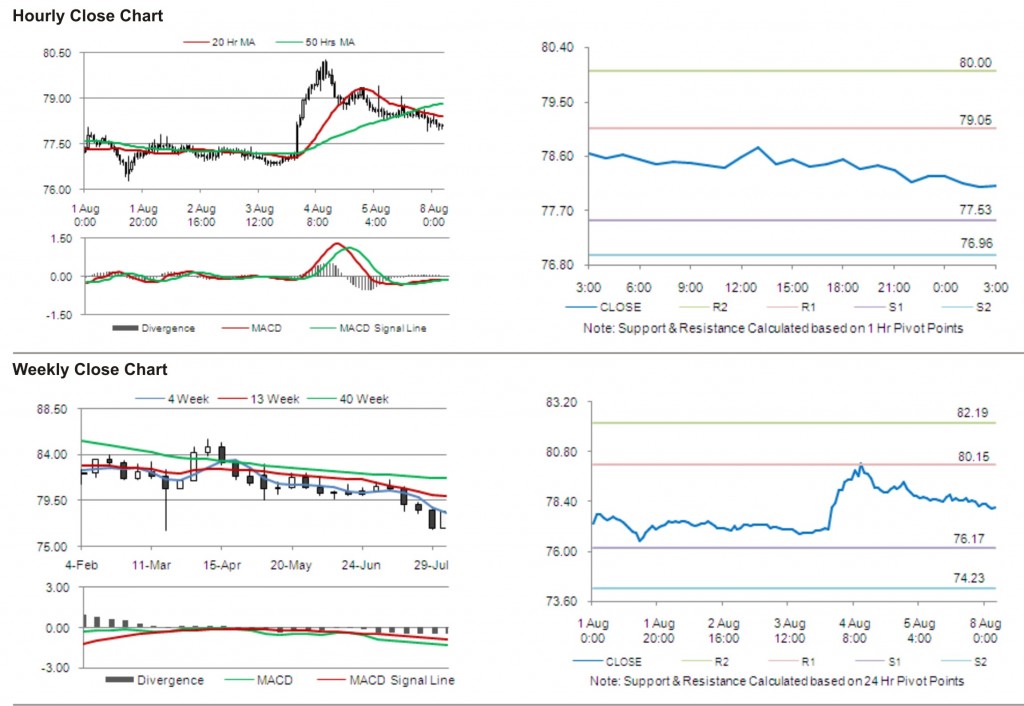

The first short term resistance is at 79.05, followed by 80.00. The pair is expected to find support at 77.53 and the subsequent support level at 76.96.

The pair is expected to trade on the cues from the release of economic watchers survey data in Japan.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.