For the 24 hours to 23:00 GMT, EUR rose 1.51% against the USD, on Friday, and closed at 1.4278, after reports indicated that the European Central Bank (ECB) would commence purchasing Italian bonds in exchange for fiscal reforms.

Late Friday, the Standard & Poor’s rating agency downgraded the US sovereign credit rating by one notch to ‘AA+’ from ‘AAA’ with a negative outlook.

The Group of Seven nations stated that it would take “all necessary measures to support financial stability and growth”. It also mentioned that the members would inject liquidity and act against disorderly currency moves as needed.

In the economic news, the industrial output in Germany, on a monthly basis, declined by 1.1% in June, following a 0.9% rise recorded in the previous month.

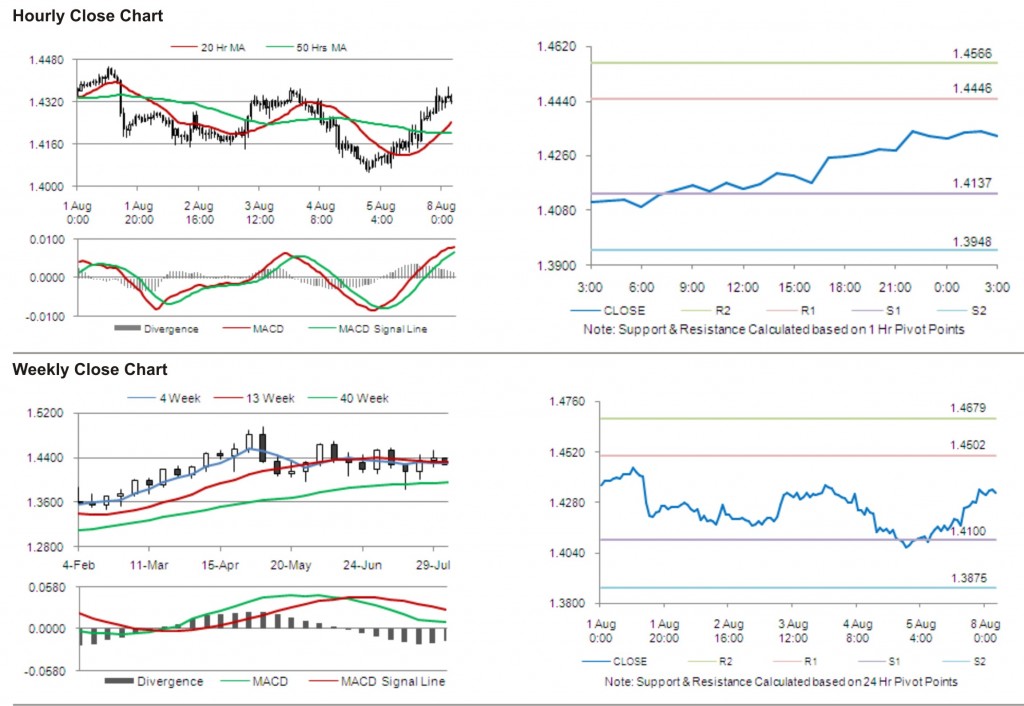

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4325, 0.33% higher from the levels on Friday at 23:00GMT.

The pair has its first short term resistance at 1.4446, followed by the next resistance at 1.4566. The first support is at 1.4137, with the subsequent support at 1.3948.

Trading trends in the pair today are expected to be determined by release of Sentix investor confidence data in the Euro zone

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.