For the 24 hours to 23:00 GMT, the USD strengthened 0.07% against the JPY and closed at 101.54.

In the Asian session, at GMT0300, the pair is trading at 101.56, with the USD trading marginally higher from yesterday’s close.

The Japanese Yen weakened against the greenback after adjusted merchandise trade deficit of Japan widened to ¥1,080.8 billion in June, compared to market expectations of a deficit of ¥1,119.9 billion. Japan had posted a revised adjusted merchandise trade deficit of ¥861.3 billion in the previous month. Additionally, the manufacturing activity in the nation also dropped to a reading of 50.8 in July, following a reading of 51.5 in the previous month.

Early today, BoJ Board Member, Sayuri Shirai stated that Japan is showing signs of coming out of deflation and the nation’s inflation target at 2% can be reached and maintained.

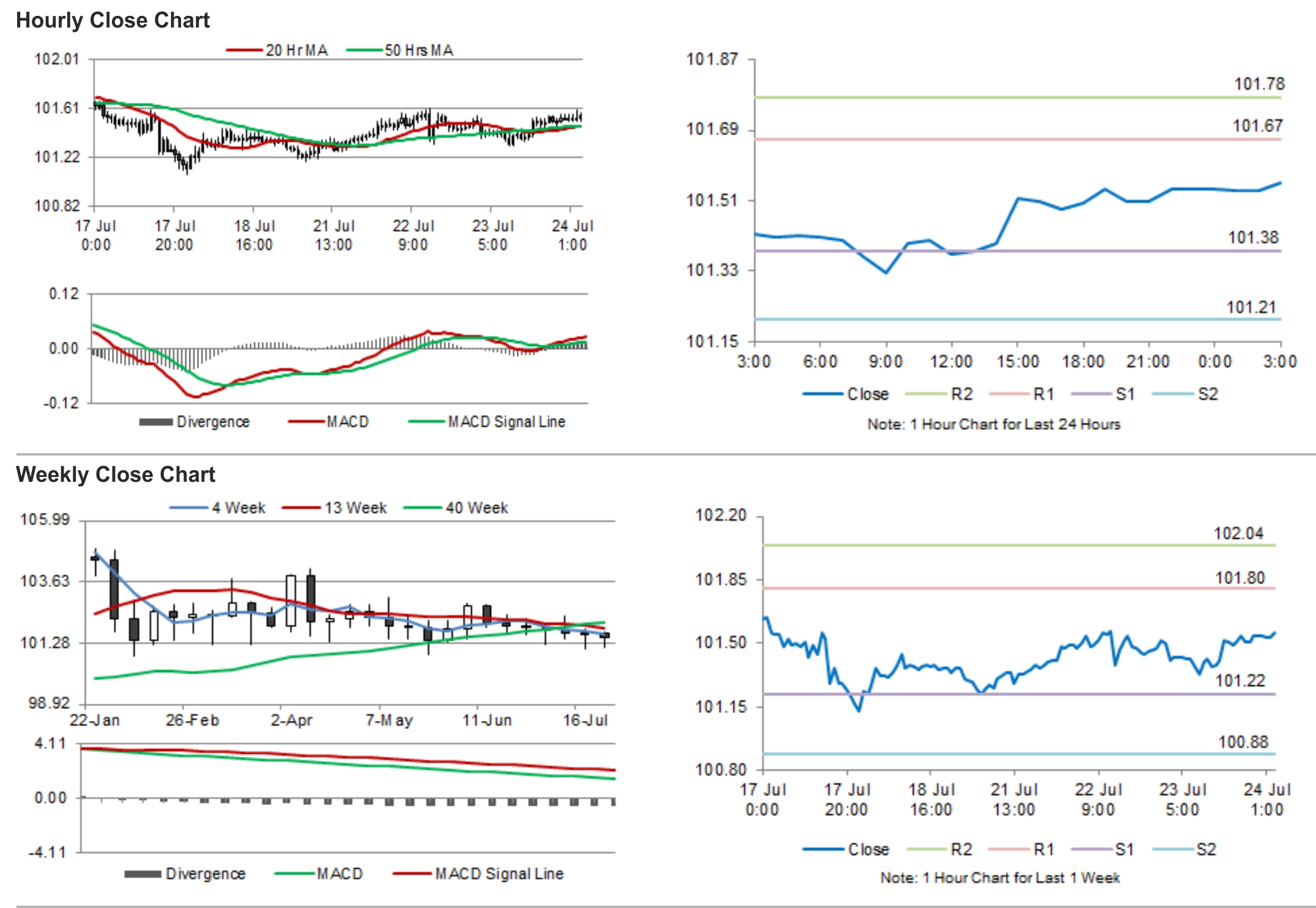

The pair is expected to find support at 101.38, and a fall through could take it to the next support level of 101.21. The pair is expected to find its first resistance at 101.67, and a rise through could take it to the next resistance level of 101.78.

Trading trends in the Yen today are expected to be determined by the crucial consumer prices numbers from Japan, slated to release in the midnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.