For the 24 hours to 23:00 GMT, the USD weakened 0.50% against the JPY and closed at 102.11.

On the macro front, Japan’s leading index rose to a level of 105.5 in June, for the first time in 5 months, from a level of 104.8 a month ago. Meanwhile, the coincident index eased in June, dropped to 109.4 in June, compared to a level of 111.3 in the prior month. Market had expected it to drop to a level of 109.6.

In the Asian session, at GMT0300, the pair is trading at 102.19, with the USD trading 0.07% higher from yesterday’s close.

Earlier morning, data revealed that the foreign reserves surplus in Japan narrowed to $1,276.0 billion in July, compared to $1,283.9 billion in the previous month. Meanwhile, foreign investors have been net buyers of ¥94.9 billion worth of Japanese stocks for the week ended 1st August, as compared to being net buyers of ¥203.3 billion worth of Japanese stocks in the previous week.

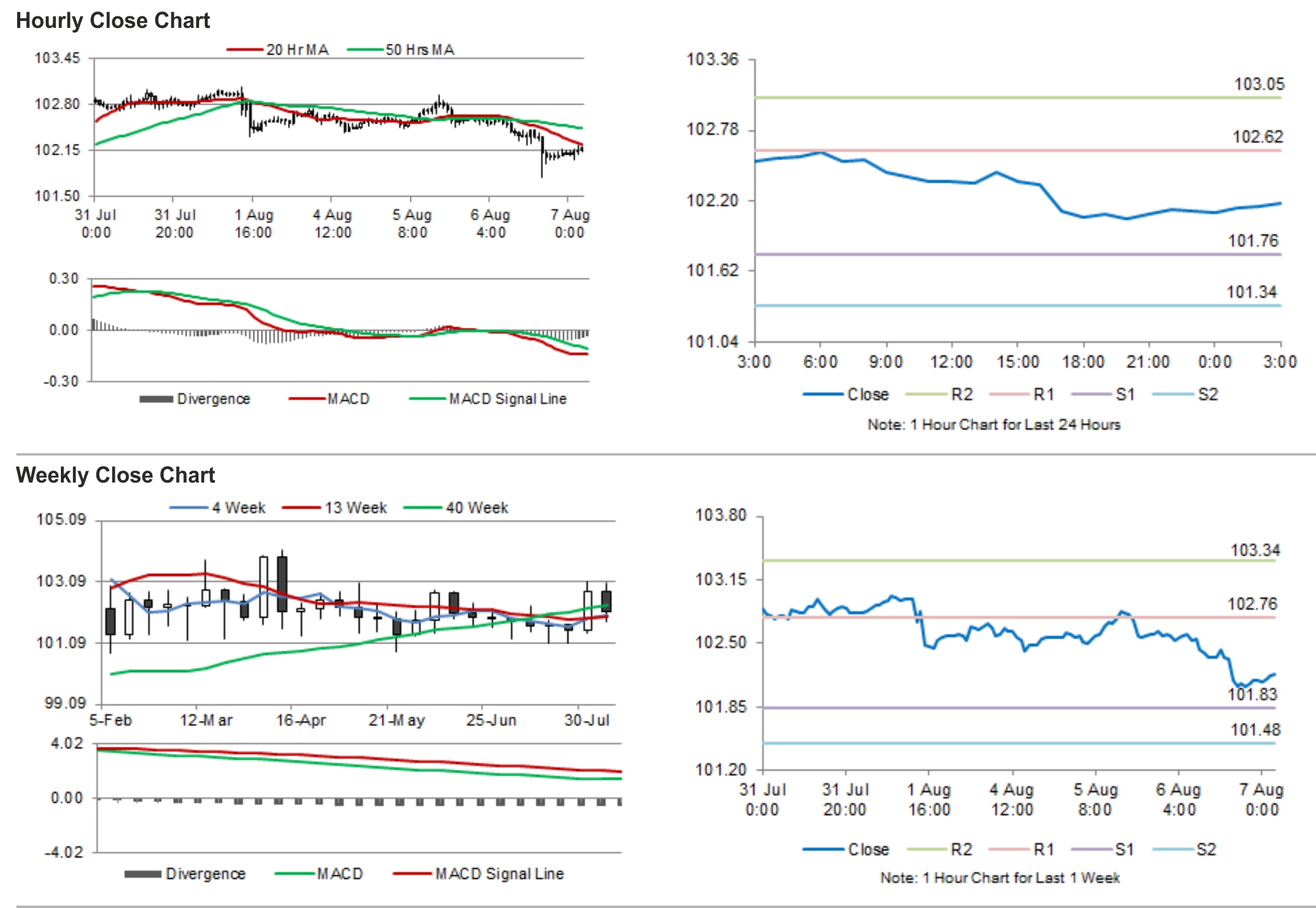

The pair is expected to find support at 101.76, and a fall through could take it to the next support level of 101.34. The pair is expected to find its first resistance at 102.62, and a rise through could take it to the next resistance level of 103.05.

Going forward, investors would be looking at Thursday’s Japanese trade balance and the much awaited BoJ’s monetary policy statement and July Eco Watchers Survey, slated to release on Friday.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.