For the 24 hours to 23:00 GMT, the USD declined 0.01% against the JPY and closed at 121.21.

Over the weekend, the preliminary industrial production in Japan unexpectedly eased 0.60% MoM in July, compared to a rise of 1.10% in the previous month.

Yesterday, July’s housing starts advanced 7.40% YoY in Japan, lower than market expectations for a rise of 11.00% and previous month’s 16.30% rise. The construction orders in the country dropped 4.00% YoY in July, after climbing 15.40% in the previous month. Japan’s capital spending rose lesser than expected by 5.60% in 2Q 2015. Capital spending had recorded a rise of 7.30% in the prior quarter.

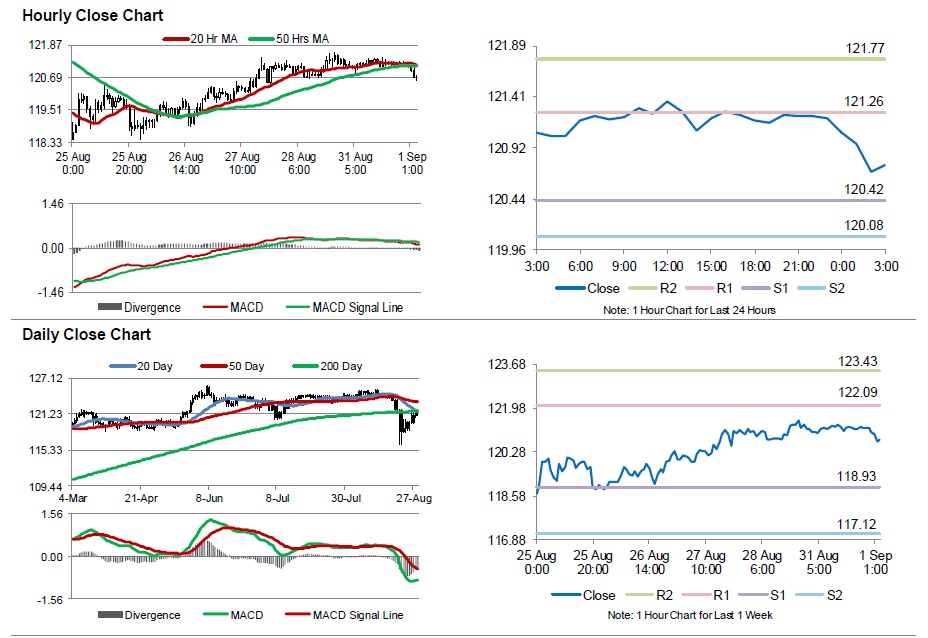

In the Asian session, at GMT0300, the pair is trading at 120.75, with the USD trading 0.37% lower from yesterday’s close.

Early this morning, the final manufacturing PMI in August advanced to 51.70 in Japan, compared to a level of 51.20 in the previous month and preliminary figure of 51.90.

The pair is expected to find support at 120.42, and a fall through could take it to the next support level of 120.08. The pair is expected to find its first resistance at 121.26, and a rise through could take it to the next resistance level of 121.77.

Going ahead, investors would watch out for the release of Japan’s monetary base data for August, scheduled in the midnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.