For the 24 hours to 23:00 GMT, the USD strengthened 0.15% against the JPY and closed at 102.13. However, the gains were capped after the minutes from the Fed’s March policy meeting failed to support market expectations for an earlier-than-expected rise in the US interest rates.

Meanwhile, in Japan, the Bank of Japan’s monthly economic survey projected that the Japanese economy would continue to recover at a moderate pace in the future despite of some temporary decline in demand caused by the recent implementation of sales tax hike.

In the Asian session, at GMT0300, the pair is trading at 101.79, with the USD trading 0.33% lower from yesterday’s close.

Earlier today, a BoJ Board member, Ryuzo Miyao highlighted his expectations for the Japanese economy to continue to grow above its potential rate even after the temporary shock from a sales tax hike in April. Additionally, he opined that the recent gains in consumer spending were due to improving underlying demand, which in turn could increase upward pressure on prices.

On the economic front, machinery orders in Japan fell 8.8% (MoM) in February, more than analysts’ call for a 3.0% fall and compared to a 13.4% rise in the previous month.

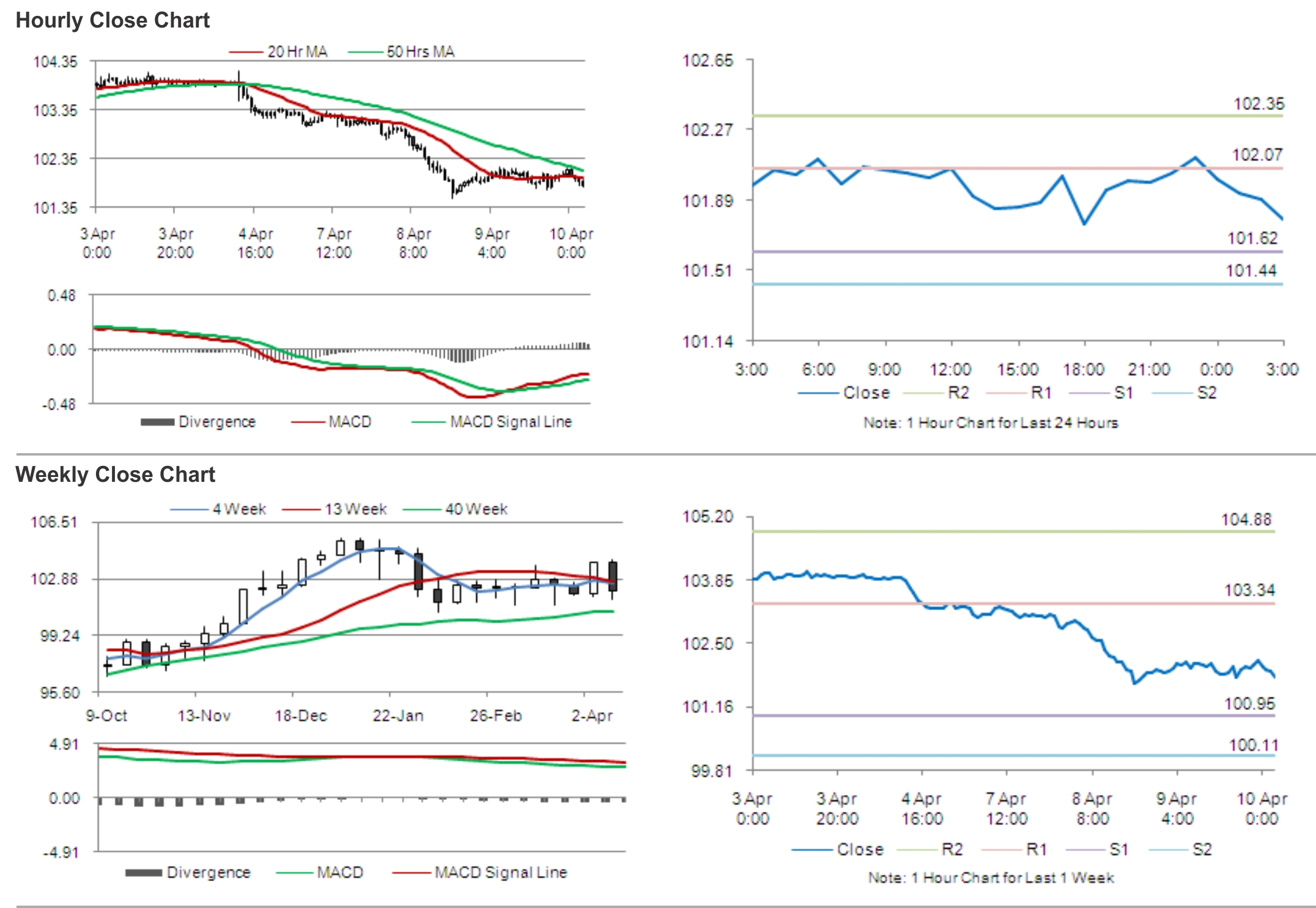

The pair is expected to find support at 101.62, and a fall through could take it to the next support level of 101.44. The pair is expected to find its first resistance at 102.07, and a rise through could take it to the next resistance level of 102.35.

Traders keenly await the release of the minutes from the BoJ’s latest policy meeting for further cues in the Japanese Yen.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.